One of the most asked questions from clients and realtors alike, is “How much do I qualify for?” or “How much can I afford?”, and most of the time it is not a simple question to answer.

We need to know client’s income, car loans amount and payments, student loans amount and payments, unsecured car loans amount and payments, credit card balances, unsecured lines of credit balances, credit score, and even amount of down-payment – depending under which mortgage program client is applying.

Knowing this information can be crucial not only to find out how much a client qualifies for but also for getting the deal approved. This is why as mortgage professionals we always ask for a mortgage application and confirmation of income upfront, even when doing pre-approvals. The mortgage application gives us an over all idea of the financial situation and client’s signature allows us to see the credit bureau which gives all the important details regarding credit. The income confirmation is needed in order for us to make sure the amounts are exact, so we do not give the wrong qualification amounts.

While there is a lot of detail that goes into calculating the qualification ratios, we can also provide you with a general idea of how much you can qualify for based on your income.

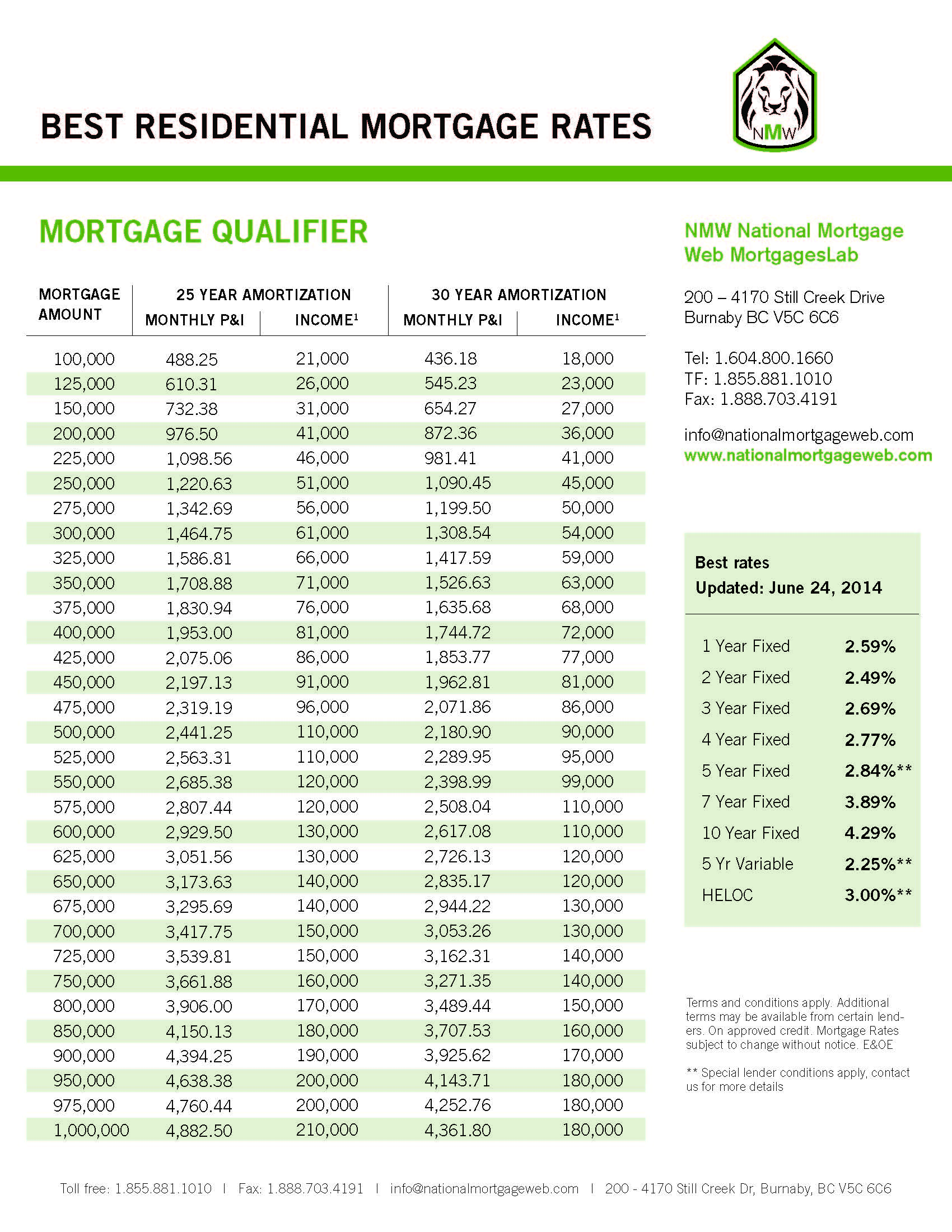

Please take a look at the affordability chart below as a general reference (if you would like to get a proper pre-approval done please don’t hesitate to contact us):

If you would like to download a copy that your can print for your personal use of if you are a realtor looking to use it for your open houses, click here: Download Mortgage Qualifier